Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

What can you do immediately to improve your credit score and start rebuilding your credit after a “bad time”?

As you may be aware from the snippets of our story, we had a Personal Economic Collapse that we had to dig out from and now we are actually in this process of rebuilding our credit.

So, What did we learn?

5 Steps to take today to check your Credit Score

Here are five steps to take today to get you started on the Road To Recovery.

1. Request a Guaranteed MasterCard with a very low limit. We went with Capital One, https://www.capitalone.ca/credit-cards/guaranteed-mastercard/ although there are others that you could choose from. We requested a limit of $300 and we won’t increase that limit EVER.

2. Use this card once or twice a month for a nominal purchase – say $40 of gas for the car. Don’t spend the “Gas Money” in your budget on something else now! That is still Gas money but you will pay it to the credit card instead of putting it directly into the tank.

3. WAIT for the statement to arrive. Paying off the purchase before it has had time to register is not helping you. UPDATE: Apparently this is a myth. Check out the newest post on Financial Myths…busted!

4. Pay the statement balance in FULL before the DUE DATE.

5. As a short term strategy – do not close any clear credit or store cards. The Credit algorithm looks at how much credit you are using as a percentage of how much you have available. If you have a small credit card and a store card with combined limits of $1000 and you have a balance in use of $40 (gas purchase) then you are only using 4% of you available credit. They Like This 🙂

Warning!

Do not open new cards unnecessarily as a way to improve your credit scores. Each time you request a credit card the application process leaves a “footprint” on your account which can negatively affect your score.

Keeping informed.

We suggest getting your credit report and understanding your credit score before you start this process and then chart your progress each quarter.

The two main reporting agencies are Equifax.https://www.consumer.equifax.ca/ and TransUnion https://www.transunion.ca/.

Both of these agencies try to get you to pay for your report but if you request it in writing to be mailed to you it is free – it just takes longer… a lot longer. If you are going to rebuild your credit it might be advisable to sign up for one of their reporting programs.

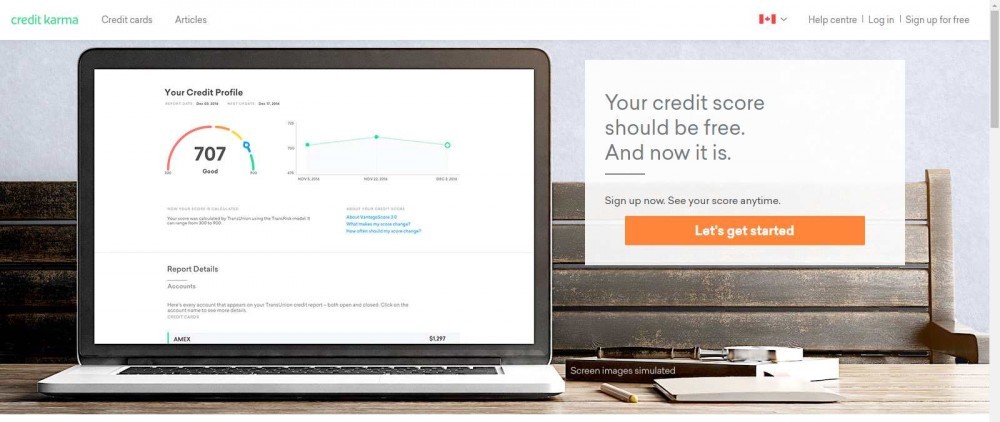

As a quick way to look at our credit scores we are using Karma, which is completely free. https://www.creditkarma.ca/. It gives a lovely little snapshot that you can check out at any time.

Why not let me know where you are at in your debt recovery process and what products you favor. I’m curious to know.

X0

Anna

Leave a Reply