Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

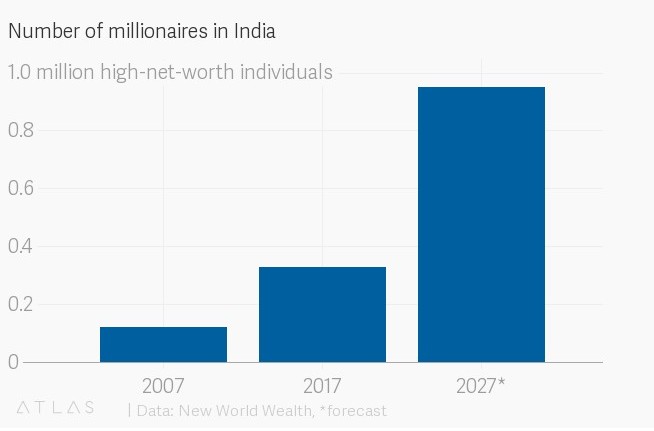

In doing my research today I came across an amazing piece of information: India will have almost 1 million MILLIONAIRES by 2027! (World Economic forum)

I was actually researching Credit card Debt and the “Average” American… I know – I’m Canadian but the stats for Canada just aren’t as robust.

So, this got me to pondering…what are we in the West doing wrong and how can I help get the message out to turn this tide around so we can learn from our Eastern family?

Are we in the West moving backwards at an increasing speed?

I’m not doing politics here so, I will start with the biggest thing that was on my list:

Credit Card Debt ~ a silent killer?

Taken to the Grave…by debt

Credit card debt is the 2nd most common type of debt (after mortgage debt) and the average American had more than $8500 in credit card debt back in 2016 (Wallet Hub survey 2016). Can you imagine where they are today with the way the economy has gone since then?

When my family suffered it’s Personal Economic collapse (also in 2016) after my husband and I both lost our jobs, we were $88,000 CAD in debt (not including the mortgage)!!

Now – OK…$45,000 was our brand new truck and $10,000 was my car but still… that leaves $33,000 in loans, equipment finance and credit cards. GULP!! Slightly more than the “average American then. I would wake up in the middle of the night (that’s if I could sleep at all) in a panic thinking about how much money we owed and how to try to dig out from underneath it.

Here are the FIRST THREE THINGS you have to do…TODAY!

Pay off new charges every month.

Make me a promise that as of today you will not build any new debt using a credit card. If you can’t pay the balance in full STOP CHARGING things to the card. It means you can’t afford them. Drop the pretense to your friends that you’re fine and stop trying to keep up with them. Cut back on your spending and do it now.

Using physical money creates a tangible awareness of it. If it’s not in your wallet you can’t spend it. If your cash reserves are getting low you rethink the purchase. All impulse is taken away.

Don’t charge small items.

You would be shocked at how fast those inconsequential amounts add up. A Latte here, a magazine there. Before you know it you’ve added a few hundred dollars to this months credit card bill and I’m betting you didn’t budget for it so now… what are you going to do?

You’re going to let it ride for a month and just pay the minimum right? Let me draw you a picture..

You racked up $100 on “stuff” this month and can’t pay it back in full. Interest rates are around 20% APR (approx $24). In two months you owe $144 for $100 worth of purchases. That’s almost 1 and a half times what you spent.

Interest compounds and it racks up quickly. [ Compound Interest]

Pay off existing debt using the Snowball technique.

Time to get creative. If you can find $100 a month to throw at just one credit card, on top of what you usually pay you will be able

to start your snowball (cascade/ avalanche). Keep that up until the debt is cleared whilst still maintaining your minimum payments on your other cards. Next take the $100 and the minimum payment from that first (now cleared) card and apply that money plus the minimum you currently pay on your next card, to the next card.

In this instance you are applying the extra $100, the $x minimum of card one and $x minimum of card two, all against the debt on card two.

Repeat this pattern until all of your cards are clear.

We can’t all be millionaires.

That’s a fact, but we can all be financially free. It takes a change of mindset and a little help.

Click Here to download my free copy “Mindsets of the Worlds Wealthiest People” and learn the 10 simple skills that every wealthy person On The Planet does, then copy them.

It is time for all of us to lift ourselves out of poverty and onto the road of riches. It’s not easy but it is do-able.

Until next time.

XO

Anna

Such a ridiculous way to spend your money. Just as well we burned it.

Hi Cheryl -you’re absolutely right. I don’t have a credit card anymore (3 years now) and people look at me like I’ve got two heads when I say that 🙂