Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

10 Things I Wish I’d Known When I Was In Debt

I’ve been researching and remembering back to when we were heavily in debt, and there are at least 10 Things I wish I had known then.

#1 – You have to educate yourself before you jump off the cliff. Know your options.

Had we known about Consumer Proposals and the dangers of Consolidation loans when we first hit our threshold, (and I say “first” because we have hit this threshold three times in the last twenty years,) we may have done things a little differently from the start and we may have only gotten neck deep in debt the once; learned a lesson; educated ourselves and never strayed down that path again.

It’s important for you to stop, breathe, research and reach out BEFORE things get out of control and your left with reaction instead of being proactive.

Related posts:

Clearing Debt Like your Life depends on it.

I just got fired! Now what should I do?

#2 – Change your relationship with money or you end up back at square 1.

Mindset is a throwaway word but to actually understand your relationship with money, how it works for you (and not you for it), and the best way to deal with finances, thinking like a Rich Person, isn’t throwaway AT ALL. I was educated to be a Financial Accountant but my relationship with my personal finances was one of disdain and loathing.

My Financial education was turned on it’s head by our counselors at 4 pillars.

Download the free PDF e report to delve into Mindsets and alter your relationship with Money today. (No email sign up required – you’re safe!)

#3 – Paying a smaller amount with each pay cheque rather than one amount when the statement arrives brings the balance down sooner and reduces interest costs.

Who knew? Although, when you actually think about it, it makes perfect sense. I get paid weekly and so, by allocating a portion of my weekly pay cheque to a credit card or loan balance I would have reduced the principal on a weekly basis, making the monthly interest calculation less.

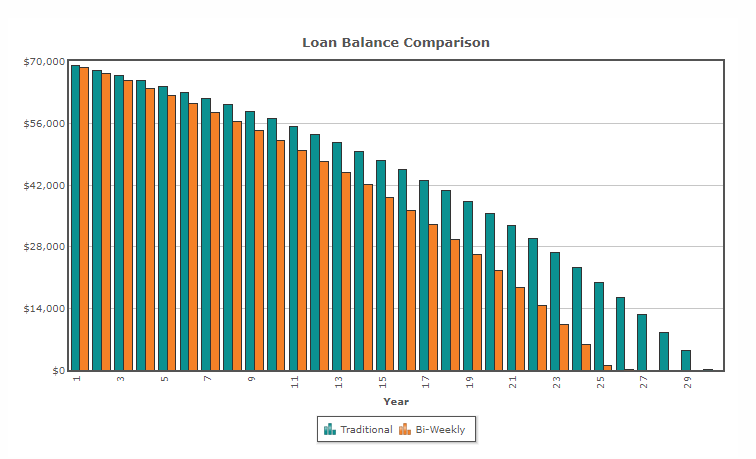

Take a look at this chart showing the difference bi-weekly payments make versus once per month.

In this instance the $70,000 is paid off almost five years earlier.

#4 – Stockpiles are life savers.

When things were really bad and we had cut off every element of outgoing spend, cell phones, cable, etc, I took comfort in knowing that I had a years supply of toilet rolls and shampoo, oats, pasta and sauce, rice, toothpaste, etc in my stockpiles cupboard. This way I could focus our meager grocery budget on just food and go five finger shopping in my stores for the rest.

You make think I’m crazy but, I have a faddy nature and I binge watched Doomsday Preppers. It kind of made sense to have insurance for, you know, zombies n such.

In the harsh light of day you and I need never worry about Zombies but job loss? Oh yeah baby. I have that T-shirt.

#5 – Focus on the smaller wins: if your plan takes ten years and you look at that big picture you might become disheartened and give up. If one card will take 6 months – focus on that.

When you prepare you financial budget and plan for getting Debt Free you may look at it and just want to give up immediately. If it will take a long time to accomplish the mission, break it down into bite sized pieces. Focus on one debt at a time and celebrate every small win.

Debt doesn’t have to be a life sentence but when you’re looking at Ten years with no hope of Parole it can sure seem that way.

#6 – Don’t plan on having next weeks pay cheque. What’s your back up / fall back position?

This might sound ridiculous but think about it. If you get Fired on Friday, how will you pay the rent this month? An Emergency fund is imperative! You don’t want to have to go back to relying on credit cards until you find a new position. Even if you can only find $10 a week, in one year you have over $500. It doesn’t seem like much but lets say something happens five years from now…you have over $2500 in your fund. Of course, once we are debt free it is wise to look at beefing up that fund a little.

There’s nothing better to help you sleep at night than knowing you are now prepared for the worst.

#7 – Hiding your financial situation doesn’t help. Swallow that pride.

It’s ridiculous to think you are alone in this situation. I had a nasty habit of accepting nights out with my friends, buying something new to wear, insisting on picking up checks for meals, etc, ALL THE TIME KNOWING I COULDN’T AFFORD IT!

Had I just said to my friends “Sorry – I’m neck deep in debt and if I don’t do something about it, like now, I’m going to be looking at bankruptcy, so…No. Sorry. Not tonight.” I may have been able to avoid a consumer proposal entirely and actually have been able to budget and manage my money better, if this had been my focus instead of what my friends might think.

We just came back from our first family vacation in four years and I’ve missed my girlfriends but, when one suggested dinner and drinks to catch up, I asked if we could do something “non-spendy” instead because I want to put back the extra we spent upgrading our vacation to VIP status. Straight away we were bringing Coffee’s from home and taking a walk through the scenic trails close to my home that leads to the beach instead. It’s about spending time with your friends not “spending” with your friends.

Read Spendaholics – “En Vacance”. It’s a tongue in cheek write up of our recent trip and how we were able to upgrade to VIP status and what that meant for us. I thought it was hilarious.

#8 – Your kids won’t die if they don’t have a cell phone / car / whatever.

I laugh now when we get that reaction. You know, the one were you say you don’t have a cell phone and that person looks at you like you’re an Alien. My kids are used to it too. At 19 my daughter is about to get a phone to take to school with her. She will be on the mainland away from everyone she knows and so, this is a necessity, not a luxury.

I still do not have a cell phone (not since 2016) even though we could probably afford one now. My friends are used to sending me messages by other means and, if I’m not at my laptop, then I’m not available at this time. They won’t die if they have to wait a few hours for a response. In an emergency they know my work numbers!

Although we have a Truck and a car we very rarely operate the two vehicles. It has been exactly 10 weeks since we went back to being a two vehicle family and the truck gets one run out every two weeks – to the city dump. That’s it. The car is small, economical, reliable and our schedules are so flexible we rarely need to be in different parts of the city at the same time.

We budget our time as carefully as we do our money. No one wants to make extra runs to town when we can schedule a route that takes each of us to the places we need to visit and then home again in one trip.

#9 – People like me Do NOT win the lottery. Knuckle down and Git ‘er done.

How many times have you spent your imagined lottery win? First you would get rid of debts. Next we are treating some friends and family to something great. After that we are buying a big house, new car, Private Island (don’t judge). Perhaps we will set up a trust for each of the kids….

WAKE UP.

Do you know what the chances of actually wining a substantial amount of money on the lottery are? (sniff) Thought so.

Stop dreaming and start planning. Who’s to say you won’t be that one in 13,983,816 (yes, that’s almost 14 million)? Wouldn’t it be nice to have the extra cash to donate or invest instead of allocating Debt payoff as your #1 priority?

#10 – Get the whole family on the same page. It won’t work if one of you keeps spending whilst the other is trying to save.

Related post:

In debt but still spending? How’s it affecting your relationship?

You would imagine that when a couple / partnership / family is in trouble they would automatically pull together and get on the same page. Not so my darlings, Not So.

I would like to say it was Hubster who was the culprit in this relationship but that would be a lie. He’s never been needy and the thought of shopping for new clothes, etc makes him just shudder. He’s lived most of his Adult life in chef’s whites and a white T shirt so, having any kind of style was just an alien concept. He does like a nice cigar though.

I, on the other hand, get bored. Fast.

I love new clothes, shoes, cosmetics (even though now I rarely wear make up at all), JOURNALS (Oh Ma Gawd…journals!).

In order to accommodate these unhealthy habits (cigars and journals) we have agreed on a monthly “personal” allowance. We spend that on ourselves, no questions asked. We work our monthly budgets together and we brain storm HOW we shall pay for an item BEFORE we purchase said item. We work as a team.

In the early days I gave up and hid from our debts and from the budgets but Hubs couldn’t do it alone, because I was not on board. Once I had smartened up, I took over the finances and budgets with a vengeance, but I also cut him out of the loop so he was never sure of the account balances or what was allocated where. Recipe for disaster right there. I couldn’t make it work on my own either.

Sit the family down. Lay it out plain and simple. Ask for support.

Don’t frighten your kids but let them know that things won’t be OK if you don’t get a few priorities taken care of and what that will look like for the family moving forward.

When we lost the cell phones and ditched the cable TV we made sure we had signed up for netflix and presented this as an alternative (a cheaper alternative). We still don’t watch cable but we have added a subscription to Crave + HBO making our monthly TV bill $33.99. We use an apple box to watch Netflix and Crave.

As I said, I have two teenagers.. and no one died!

Hope this helps!

XO

Anna

PS: the banner at the top will take you to a veritable plethora of resources for getting on track with your finances. I wouldn’t recommend something I haven’t used myself and..it’s DIRT CHEAP.

Great advise especially looking for the small wins cause the overall picture can be overwhelming.